How Having a Flatmate or Renting a Room Can Help You Achieve Financial Freedom

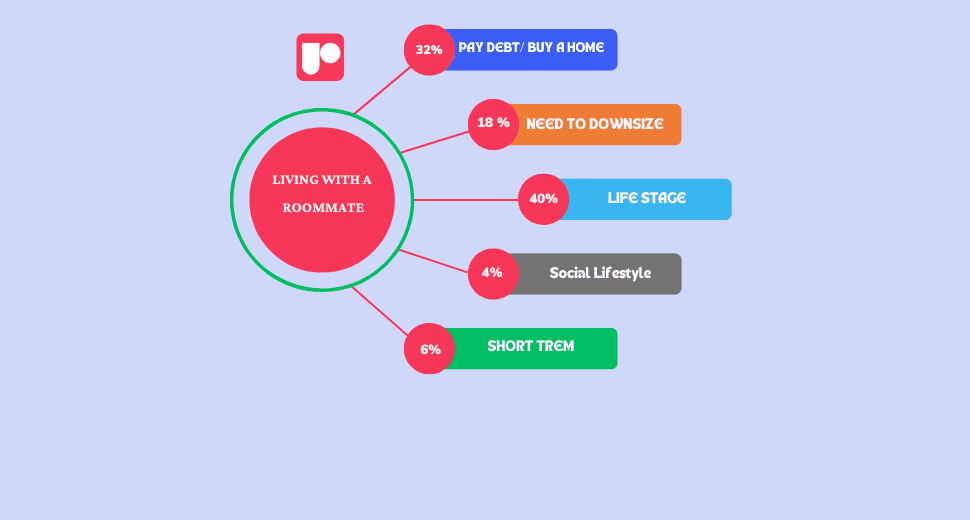

Living with flatmates can be a necessity, but it also offers advantages that extend beyond simply saving on rent. Let's delve deeper, using a recent poll conducted among iROOMit users to understand their motivations.

While nearly half (48%) of participants felt having a flatmate is a common stage in life, the remaining half (51%) shared a more strategic goal: pursuing significant financial objectives. These included saving for a home, tackling debt, or managing rising living costs.

1. Achieving Homeownership Dreams

The dream of owning a home, whether it's a charming house or a city-view flat, can feel out of reach with rising home prices, high interest rates, and stagnant wages. In our survey, 29% of respondents cited saving for major life goals as their primary reason for having a flatmate.

A significant aspiration for many is homeownership. Soaring median home prices make it a challenge for aspiring homeowners. The median home price has doubled in many states, while household incomes have only seen a modest increase since the 1970s.

Economists use the price-to-income ratio to measure housing affordability. This ratio shows how accessible housing is relative to income. For example, Denver's median household income has grown by 59% since the 1970s, while median home prices have surged by a staggering 249%.

This high price-to-income ratio (5.1) indicates a significant affordability concern.

Having a flatmate frees up disposable income to save for a home. If you already own a home, renting out a room can help pay off your mortgage faster.

2. Conquering Debt

Dealing with debt, from credit cards to student loans, is a common financial challenge. The key to tackling debt is to pay it off quickly to minimize interest accumulation. Similar to homeownership, managing debt is another major reason why people choose to have flatmates even after the young professional stage.

The average student loan debt for U.S. graduates in 2023 was a substantial £34,500. This is a significant burden for many graduates.

The average repayment period for student loans is approximately 21 years. This extended period means you end up paying a significant amount in interest over time.

Rent is a major monthly expense. The average annual rent cost in the United States is roughly £16,000, depending on location and housing type. Sharing your living space with a flatmate can effectively cut your rent in half, resulting in annual savings of around £9,000.

Imagine putting that £9,000 saved on rent towards your student loans. This can significantly reduce your debt and save you money on interest in the long run.

3. Managing Rising Expenses

In a world where expenses seem to rise constantly, many people find that living with flatmates helps combat the financial strain. According to our survey, 20% of respondents actively seek flatmates as a practical solution to rising costs.

For expats moving from countries with a high cost of living, the financial impact may not be as significant. However, for those relocating from places with a lower cost of living, the adjustment can be challenging. Sharing living spaces with flatmates can provide a buffer while they adjust to new budgeting realities.

Similarly, individuals experiencing a recent divorce may find themselves in a financial bind. In such situations, having a flatmate can offer both financial relief and companionship during a difficult time. Flatmates are becoming a versatile solution for various financial and life transitions.

Conclusion

Shared living arrangements are on the rise, with millions of people choosing to live with non-family members. From single parents forming communities to students opting for co-living, millennials and Gen Zers are finding creative ways to address financial challenges.

While saving on rent and enjoying the company of a friend are clear benefits of having a flatmate, the financial reasons go far deeper. Our survey highlights the strategic choices people make to secure their financial future, navigate high living costs, and achieve financial stability through shared expenses. Flatmates can play a vital role in helping you reach your financial goals.

Looking for a Flatmate?

Don't settle for just any flatmate. Let iROOMit help you find a flatmate who complements your lifestyle and shares your financial goals. Start your flatmate search with iROOMit today!